Research by Dr Mike Clugston shows that under the current system of student loans, 85% of students will never repay their student loans – unsurprising when the average cost of university is £43,500 – and lower income graduates will accrue far more interest than those on a higher income.

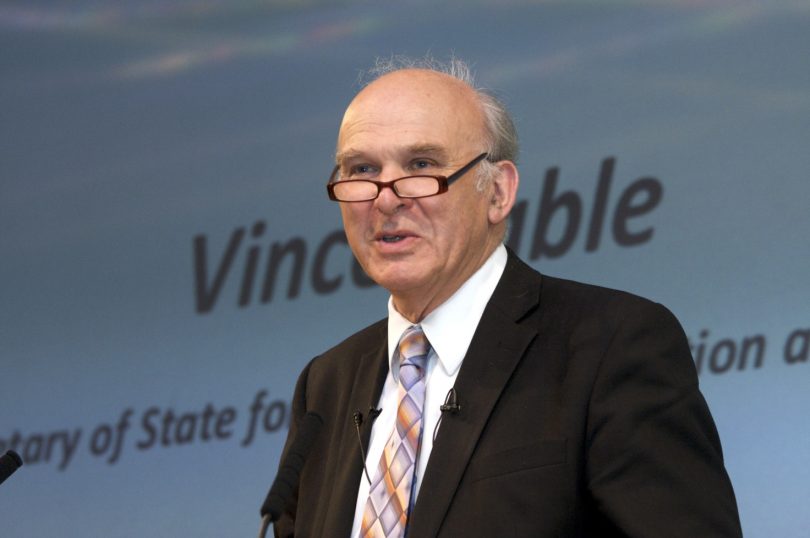

Before the last election, the idea of a ‘graduate tax’ as a fairer system of paying for university was popular with left-leaning politicians including Ed Balls, Vince Cable and current NUS President Liam Burns. Would it solve the problem of a lifetime debt that hits the poorest the hardest?

Graduate tax explained

Under the NUS-proposed system, a graduate tax would take the form of an extra 0.3%-2.5% tacked onto income tax for twenty years following graduation. Graduates would only become liable when earning above the current £21,000 threshold for student loan repayments.

This is in contrast to the current system, where students receive loans from the state-backed Student Loans Company to pay for tuition fees. Whilst studying, the loans attract interest at RPI (Retail Price Index) plus 3%. Post-graduation, interest is accrued at RPI plus additional interest pegged to income, a maximum of 3% once earning £41,000 or more. Repayments are made at 9% of any income over £21,000.

A progressive approach to university funding?

A graduate tax certainly looks simpler, but its supporters also claim it to be more progressive. The crucial piece of Dr Clugston’s research was demonstrating how compound interest made debt under the current system larger for poorer graduates – higher-income graduates pay back their loans quicker, accruing far less interest as a result.

For example, Clugston contends that starting on the national average wage of £26,600, the debt will reach £76,800 by year 30 after graduation, at which point the debt will be written off. For those starting on £21,000 (the threshold above which repayments are made) the debt will escalate to £101,942 by year 30. Contrast that with someone starting on £35,000 who will end up with £2,245 of debt by year 30.

Under a graduate tax, there would be no fixed point at which the debt is considered cleared. As such, the highest-earning graduates would end up paying past the point at which they previously would have stopped. This surplus payment would then be used to subsidise poorer students.

A graduate tax would also mean poorer students wouldn’t be saddled with an unpayable debt that may affect their ability to take out a mortgage. Although student loans currently make little difference to credit applications, the amount of disposable income does. By paying a smaller proportion of income, poorer graduates would have more money to put towards a deposit, and to make mortgage payments.

Is a graduate tax as fair as it seems?

A sizeable problem with the case for a graduate tax is that it confuses student debt with ‘real’ debt. Clugston’s research shows enormous debts accruing for lower-income graduates which are then written off. They never pay them. The amount of debt is irrelevant. What matters is the amount which is paid back. Under the current system, high-earning graduates may owe less over their lifetime, but pay more in real terms. A graduate tax may not be any more progressive than the current, already progressive, system.

Fairness is another issue. Even if the tax was more progressive and made richer graduates pay more, is it fair for the highest earners to pay far above what their degree actually cost? One could say they are paying in proportion to benefit received rather than cost of delivery, but education arguably has diminishing returns over time. The longer you work, the less your degree matters. By the time you’re 50 you’re highly unlikely to be hired based on your studies.

The big picture

The upshot of the graduate tax is that the top 10% of graduate earners could make proportionally larger contributions for their education, past the point many would consider ‘fair’.

But let’s take ‘fair’ in a wider sense. Under the current system, most students won’t ever pay back their loans. The amounts of debt quoted are irrelevant as most will be written off. Student loans make little difference to individual graduates, but the Treasury is sitting on a debt timebomb that will undoubtedly cause another funding crisis in years to come.

Is it ‘fair’ to leave an underfunded education sector to the future? Under-resourced, poor-quality universities for most, privately-funded universities for the rich. This is neither fair for students themselves, nor the economy, which depends on progressively higher levels of education for the UK to compete on a global level.

Most discussions on graduate tax sidestep the funding issue, preferring to concentrate on the effect on individuals. In real terms, a graduate tax is no fairer to poor students than the current system. But it would require a larger sacrifice on behalf of the very richest, arguably resulting in a better-funded education system for all, and the associated economic benefits.

How fair you think that is depends on where you sit on the political spectrum.

Image credit: http://farm5.staticflickr.com/4001/4669399716_e3d4c2bff5_o.jpg