Whether you are working, looking for a job or still a student at university, money is one issue that is common to all of us. Those who have a lot of it are not happy; those who don’t have much, like me, are unhappy as well.

That’s me

I used to be pretty poor in monetary decisions whilst at University and even for some time after graduating. And on some level if I hadn’t been that bad, I wouldn’t have noticed the difference. A couple of years after graduating I learnt my lessons by reading blogs and from a friend, who is really good at budgeting and planning. I took action in 2013 and saw good results, so 2014 is about doing the same and sharing my tips with you.

1. Make a budget – to save and to spend.

Making a budget isn’t hard – it’s taking stock of how much you can spend.

photo credit: kenteegardin

When I used to hear the word “budget”, I used to cringe. But it was my biggest mistake of student life and even afterwards. You don’t need to go hungry to meet a budget; broadly, there are three ways you can budget:

a. 20% hard save, 80% spend – you save 20% of your income every week/month in hard cash and budget to spend the rest of the 80%. Here, you have to be strict about how you spend. Look for savings there. Also, things like tuition fee loans or car loan repayments fall under spending. (Note: phone contracts, gym membership, etc. is also spending).

b. 40% saving, 60% spending – this is a slightly more lenient and a psychologically satisfying way to save, where things like tuition fee repayments, car loan repayments or any loan repayments are accounted for under savings. This is because over time you will repay the loan and from that point onwards this money will be extra money over and above your budget.

c. Make a budget and stick with it, save the rest – I love to follow this. I make a budget of what I want to spend each month and then save the rest. I save at the end of the month because it helps me from not going into overdraft some months. But at times, when I am on holiday, etc., I just remove my savings as soon as I get paid and then whatever remains in the account goes according to the budget.

Now, I am not a financial expert, but that is what I have noticed most people follow. The key thing is that you need to budget. Not always because it will save you money, but it also gives you an indication of where your money is going. I realised I spend £25 on a gym membership per month and about £30 on 5-a-side football a month. Not playing footy a month would save me £30 which can go towards a holiday trip I genuinely want to make. It’s a small sacrifice but it helped me put into context how much I am spending on sports. Over a year I am spending £600+ on gym and footy- is it really worth it?

2. Cook whenever and wherever possible.

Oh, those burger meals which I thought were dirt cheap, those sandwiches at University, and that lunch deal when working… All those options sound cheap for what one earns a day but it all adds up.

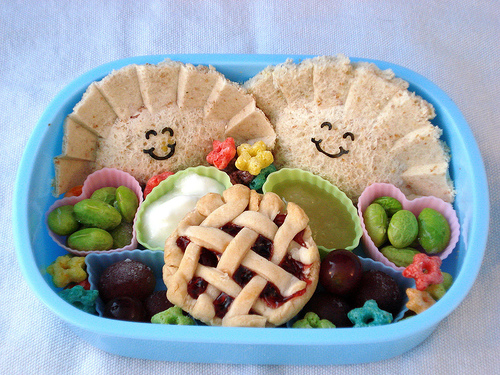

This isn’t my lunch, but you get the point.

photo credit: Sakurako Kitsa

Here are some ways I saved up and have seen a big increase in savings:

a. I pack my own lunch to work (most days). Even if it is a sandwich, I make it at home. Buying the ingredients for making lunch every week costs me £5. When I was buying a lunch I was spending £2.50-£3.50 a day, which equates to a saving of £10 per week. By simply making my lunch I now save about £40 a month, about £500 a year.

b. Avoid junk food – not only does it help you save, but it also helps being more healthy. I loved my Friday evening with junk food listening to fighting talk on BBC 5 live, but I now prefer cooking my own meal whilst listening to it.

c. Say NO to peer pressure to eat out – If you are saving, one thing you need to learn is to say NO to excess. Some days I would go eat out with different sets of friends. When I decided to start saving I realised I had to say NO to eating out a lot. And I did – it was hard, but good habits are contagious; one of your friends might pick up saving money that way, too.

So, those are my 2 broad tips to budget, plan and save for this year. It is important that you start saving money because it really helps at times when the sun is not shining. Budgeting and being in control of your money makes you self-disciplined and this will show through in your behaviour.

Note that none of the above two tips is asking you to go hungry or cancel your trips. So they should be doable and you can do it. This comes from a guy who owns 3 laptops, 1 netbook, 1 iPad and a printer. Out of all that, he only uses one laptop and the iPad. The rest £1000 was wasted. I learnt my lesson and now do everything moderately.

Make 2014 a year when you gain financial discipline.

You can follow these tips and save. Don’t doubt yourself.

photo credit: sara | b.

If you have any tips to help students, graduates and young people save money, do comment below. I would love to update this article with your tips.