- Survey finds one-fifth use body or betting to earn money

- Maintenance loan leaves average student £265 short each month

- Universities the last resort for financial advice

- Extra: the inventive ways students try to turn a buck

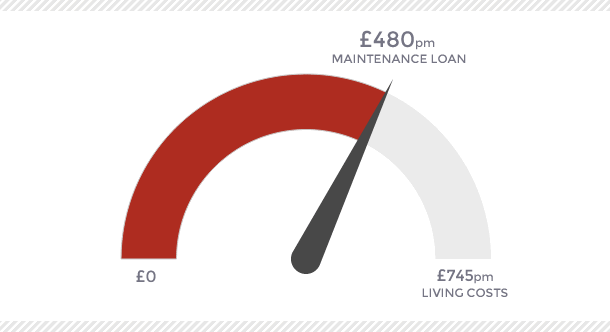

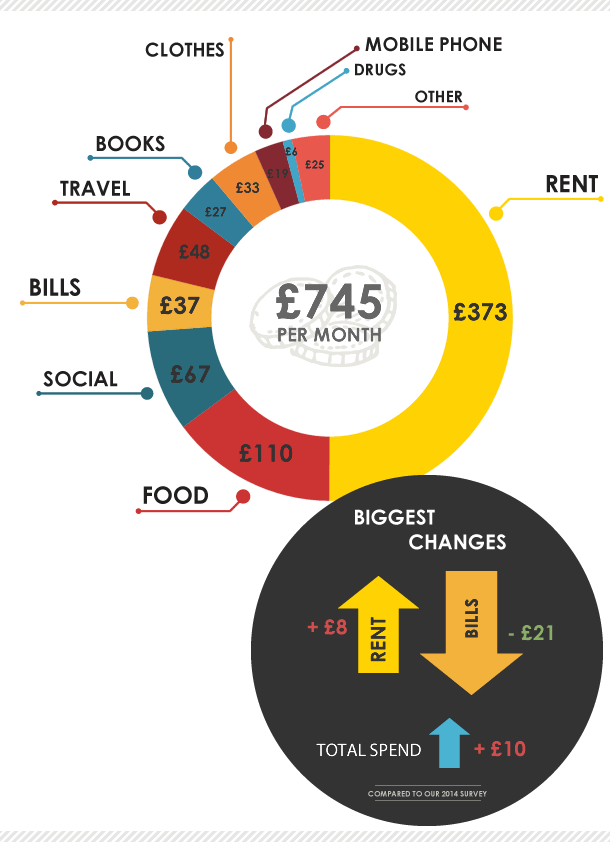

The survey of 1,900 students, conducted by money advice site Save the Student, found many use high-risk, low-paid work to cover the sizeable shortfall in student finance. The average student spends £745 each month but receives just £480 in maintenance loan.

- 12% consider gambling a legitimate income source

- 7% have undertaken Adult work or medical testing

- 8% fill out low-paying surveys in the hope of earning extra cash

- See the full survey results at www.savethestudent.org [Live from 29/6/2015]

“Fans just wanted to talk but wanted an edge – like being topless. That was it. I didn’t do anything else other than talk.

“Before, when I had a ‘conventional’ job, I really struggled with money – I am great at budgeting but money just wouldn’t stretch. I was living on £5 a week. To go from that to earning £50 a day or so was great, I could actually afford to eat and even save money!”

2nd-year Kieran volunteers for medical studies to cover his shortfall:

“I got as far as doing a trial that involved staying at a unit where an antibiotic was being trialled. I was a little ill for two weeks afterwards but there was a really good amount of aftercare. Of course I worried at first but in any other career, there are risks. I saw it as safe as the doctors don’t just leave you for dead if things go wrong”.

Recent graduate Ben started playing poker online at 16, and began playing at organised live games when he went to university:

“I grew up in rural North Wales so I’d never been to a real casino before. The standard of play at a live poker room is far worse than online so having cut my teeth with the relatively savvy online players, I started killing it while playing live. I’d say in three years playing live in Liverpool (probably two or three nights a week), I made about £6,000.”

While SLC statistics show average maintenance loan awards increasing over the last few years, students remain highly critical of a system they see as unfair to students in England or from middle-income families.

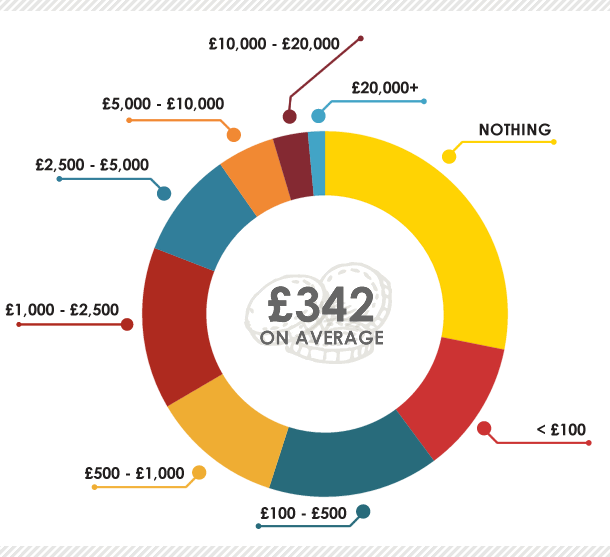

How much students have in savings

One comments: “My parents earn above the top band so I get absolute bare minimum student finance (it doesn’t even cover my rent). Just because my parents work hard and earn money doesn’t mean they necessarily have enough to give me lots of help.” A third of students surveyed agree that they don’t get enough financial support from their parents.

Many who answered the survey also wished they’d been taught better money management skills before starting a degree, with just a quarter able to budget – yet only 16% would turn to their university for help when in difficulty. Of those who did, only half found it easy to get advice or cash from their course provider.

Monthly student spend

Tom Levin of NASMA (National Association of Student Money Advisers) comments:

“The trends demonstrate how vital the maintenance loans are in ensuring they’re able to complete their studies successfully. My advice to students and parents would be to familiarise themselves with the support services on offer at their institutions: NASMA members around the country are keen to engage with students to improve financial capability and help those in hardship.”

Save the Student’s Editor-in-Chief, Owen Burek:

“1 in 2 students tell us they don’t understand the loan repayment conditions, yet are signing up for debts which aren’t fit for purpose. Maintenance loans don’t reflect real living costs, regional differences and parents’ ability to contribute – frankly, they’re out of touch with individual circumstances and student needs.

“We’ve filled the knowledge gap of money management for thousands with our ‘Big Fat Guides’ to student money – but until access payments become fairer and more relevant, all we’re doing is papering the cracks. In the meantime, we aim to show all students where the money is, whether it’s from the system or by being smarter about saving.”

1. I had to be a ‘burp’ for an online kids’ TV programme and got paid £10

2. I hired my dog out as a stud. He’s only had one job so far, might put him up on Gumtree?

3. Taking the blame for someone’s flatulence at a party

4. Sucked my friend’s toe for £100

5. Running McDonald’s trips for friends. I buy them McDonald’s with money they give me + money for my personal delivery. Didn’t cost anything to walk to McDonald’s for me, nor was the extra pay too high, but I usually earned an extra few pounds per trip

6. Holding a stranger’s cat while she went shopping in Furniture Village. Made £20 out of it.

7. Confidence coaching (basically fake dates to help shy people)

8. Doing up a drunk friend’s shirt buttons: easiest £5 I’ve ever made! (I did return it once they sobered up)

9. Taking some random photos at a horse show which the lady later wanted to buy off me!

10. Friend was unable to gamble due to lack of ID but still wanted to put bets on. So he gave me the money and told me his bet. His bet choices were always terrible so I took the money and risked paying out myself if the bet came in. None of his bets ever came in.

Source: The National Student Money Survey 2015, www.savethestudent.org